Final Expense Leads [The Ultimate Guide and Keys to Success]

Beginning a career in final expense telesales may seem overwhelming in the beginning. You are trying to learn who the best Agency may be to contract with and simply learning which final expense lead sources to use to give you’re a business a substantial boost.

We have all been there and understand the feeling.

Something that’s often overlooked early in the process of launching a final expense telesales business and career is the importance of quality leads. Leads where you understand the sources and can get a gauge on the quality early in the process.

This can make a significant difference in not only your sales but make planning ahead that much easier in the future. If you are slightly confused what I’m referring to, stick around for a moment, and I’ll break down everything you need to know when it comes to final expense leads and potential lead sources that you decide to use.

Before diving into the meat and potatoes, a few things are crucial to keep in mind.

Leads are The Life Blood of Your Agency and Your Success

Leads are top dog and critical with any form of business. It doesn’t matter what you’re selling. If you don’t have interested buyers and a pipeline bursting at the seams, it’s going to be difficult to gain traction. Trust me, I’ve been there.

However, effectively managing your leads is even more critical. This ranges and covers everything from effectively dialing all your leads to managing your cash flow for the next batch of leads that you need to purchase.

Especially if you don’t know how to develop your own leads yet. It all matters. Too many rookie mistakes, in the beginning, is something that can be fixed, but it can sure set you back and put a significant roadblock on your path to stabilizing and building a digital life insurance agency in the final expense market.

In other words. Leads are King. Plain and simple.

The Old School Way of Doing Things Is Slowly Becoming Forgotten

Listen, I get it. Does door knocking work? Yes. Do final expense direct mail leads work? Absolutely. However, these methods work for a select few that still prefer to pound the pavement. Another thing about using these methods is what’s often overlooked.

Time.

Time is money. If you have a family, kids and other obligations, I don’t think anyone here can argue that time is not the most valuable commodity that we have. Old school methods of selling life insurance can still work and perhaps even deliver at impressive percentages.

This doesn’t mean you can’t find better options for selling final expense life insurance over the phone.

However, they take time. Lots of time, and that’s what we are after saving. You see, when some lead vendors have post on google that you read and naturally grow curious about, it’s always the same song they are singing.

We have the best leads in town at the best price, and you can close 40% of your sales! Woo-hoo. First off, this is false, and they aren’t even covering the information you need the most.

Understanding where the leads come from and what makes the prospects interested.

Quality Leads from a Trusted Source Create Time and Create Money

Without quality leads that can be delivered consistently and at scale when you choose, you can never truly hit your potential with life insurance sales in the final expense market. Especially in the digital life insurance sales era where most of your business is completed over the phone or by email and even SMS text messaging.

You see, agents see leads as a mega expense when it comes to running a life insurance business. Perhaps it is. However, what agents often fail to realize is that all businesses have these same expenses.

Sure, they may vary some, but you can’t run a business that creates significant income without expenses, a risk from time to time and the ability to grind and work hard.

Quality leads at chosen volumes is by far the most significant factor any agent selling final expense life insurance needs to make a killing in this industry.

The Problems with Un-Trusted Lead Sources and Un-Predictable Volumes

First and foremost, poor quality leads from sources you don’t know or don’t trust can hurt you in a few ways. Poor quality leads are going to kill confidence. Especially in the final expense market.

You see, building rapport and trust with your prospects in the final expense market takes enough patience as it is. To eliminate some of this stress and learning curve, having quality leads can make the most significant difference.

Speaking to individuals who are interested in your offer, willing to talk and present a real opportunity for a sale is what you need. Especially in the beginning. It’s all a numbers game with selling final expense life insurance over the phone.

The more interested prospects you can speak to, the better chance you have at building momentum, confidence and a pipeline that’s going to pay you month after month.

Having Leads You Can Trust and Understanding the Source Creates Sales

Now, you have the flip side of un-trusted leads or low-quality leads. When you can begin working leads where you can depend on volume and understand the source, the power can shift into your corner.

For example. Simply being able to reference where a lead requested information from is huge towards building credibility and rapport with your prospects. Having real-time leads delivered into your CRM and showing valuable information such as the following is critical towards making more sales.

• Amount of Coverage Requested

• Age (Date of Birth)

• Name

• Phone Number

• Address

• Website Information Was Requested From

A lot of that information probably looks typical from many lead sources. Except for one critical piece of information which is the “website information or lead source.”

This shifts a typical sales call where you sound like every other cold caller and telemarketer to something much more powerful and trustworthy. Now, you can use power statements such as the following.

“Hello Bob, you had visited finalexpenselifeinsurance.com requesting information, and I wanted to call and help facilitate the application process with you.”

Now, they know where you are calling from, who you are and typically don’t deny visiting that webpage. You have the information needed at this point to start leveraging knowledge to control the conversation.

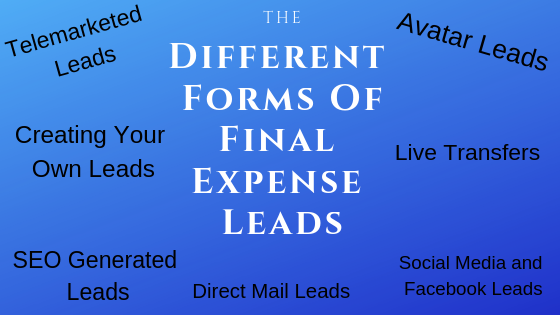

The problem you run into with this theory? Not all leads are created equal, and not all leads work in this fashion. That’s what this entire post is about. I want to go over the ins and outs of the different final expense leads that you can lean on to grow your business and discuss the pros and cons of each of them.

Let’s dive into some potential lead sources that are popular and available in 2019 for selling final expense life insurance over the phone.

#1- Final Expense SEO (Search Engine Optimization) Leads

Search Engine Optimized leads are perhaps the highest quality leads you can work. This is for a few reasons. First, you are ranking “organically” in googles search results. This means you are not paying for ads or pay per click campaigns.

Many individuals in 2019 are avoiding paid ads in specific niches (thankfully, final expense life insurance isn’t one of those yet) and a strong sense of trust can be developed with organic results that provide valuable information to your reader.

The problem with search engine optimized leads is that they are challenging to scale. It also takes an insane amount of work and dedication to developing these leads. Sometimes it can take a year before leads become consistent and sadly, many individuals are not willing to take this kind of time to invest in themselves.

However, that doesn’t mean that you at a complete loss. A strong Agency may develop their own in-house SEO generated leads and have done the leg work for you. This could mean that the volume is lower, but the quality remains superior over many other lead sources.

We can discuss SEO generated leads more in-depth if you stick around till the end of this post when we discuss learning your own marketing methods and channels. For now, let’s move on to social media generated leads.

#2- Final Expense Social Media Leads (Paid Social Media Ads, Facebook)

Social media leads can technically be developed using multiple channels, but Facebook is by far the most popular. With social media leads, you are typically running a paid ad and driving your final expense prospects to a landing page where they request further information about final expense life insurance.

These can be great for a few reasons. First, the quality is still solid. Secondly, once you learn how to create these advertisements, you can scale the volume by increasing the budget or by optimizing further as you learn this channel in more depth.

Or, you can simply take option 3 and work with an Agency who also develops these leads in house using trusted sources and that makes these leads exclusive to one agent at cost. No markups.

Nonetheless, social media leads are one of the most popular and highest converting lead sources for final expense life insurance sales over the phone.

#3 Final Expense Avatar Leads

Final expense avatar leads aren’t discussed nearly as often as they used to be. Part of this is due to reputation and how avatar leads work.

Avatar leads are very similar to telemarketed leads. The biggest difference between the two is the fact that avatar leads are using more “canned responses” and computer-generated response to continue a conversation with a prospect.

Nothing is necessarily terrible about this, but life insurance is typically sold in the final expense market due to rapport building and a sense of trust. These leads aren’t going to create that same feeling or atmosphere for your clients and prospects.

These leads do have the capability of being relatively cheap but based on my knowledge in this industry, I would lean towards paying for 13.00-20.00 leads that are higher quality and have a real relationship being formed over the phone.

The rapport and trust needed in this market is under-estimated and learning to build it can skyrocket your sales.

Based on this, I suppose you can say that avatar leads are not my cup of tea.

#4- Final Expense Aged Leads

Aged leads, although not as popular as they once were can still serve a valuable purpose towards building a business. In my opinion, aged leads can make a fantastic supplement to your pipeline at low cost.

Many agents built their careers calling aged leads. Now, it does take a particular person to have the work ethic to make the dials to make aged leads profitable, but it’s certainly possible. In fact, depending on what you consider aged leads, I’d argue they are simple to flip a profit for.

Aged leads work fantastic when other sources are low on volume or when cash flow may be slightly tight.

Consider throwing some aged leads into the mix from a reputable source and keep your activity high and continue to dial until you start generating hot prospects and more follow-ups/deals.

Aged leads should never be your primary business, but they should always be considered if you need to get back on the phones and talking to individuals who have been at least “interested in recent time” in final expense life insurance.

#5- Final Expense Direct Mail Leads

Direct mail leads in the final expense can be fantastic.

However, they are not excellent for the digital life insurance agent who is attempting to sell life insurance remotely or attempting to sell final expense life insurance from home and over the phone.

Since selling final expense life insurance over the phone and from home is our primary focus, we don’t typically recommend purchasing direct mail leads. They are too expensive for what you are trying to accomplish.

Final expense direct mail leads are basically a business card that someone has filled out a reply to state that they are interested in hearing more about final expense life insurance.

With direct mail leads, your prospects receive their card in the mail that allows them to fill out the bottom portion of the card and mail it back out. This is how the lead is created. These leads are somewhat popular due to the ability to avoid the “do not call list.”

Let’s say for example you mail out a batch of these direct mail offers (around 10,000), you may get 100-150 interested leads to return the bottom portion of the card.

If you were to try and solicit the same individuals via phone, you would run into many individuals who are on the do not call list and that shouldn’t be contacted (if you are following the DNC laws)

So, What’s the Problem?

In theory, nothing is wrong with direct mail leads. If you still feel like pounding the pavement, driving to appointments and working in a small area.

Now, I do understand that you could call these leads and attempt to sell these prospects over the phone, but that’s not where direct mail leads got their strong reputation.

Direct mail leads have been used primarily to convert highly on face to face meetings in small cities or towns where you can mail the response card out to the entire community.

If you genuinely want to work from home and call quality leads at a lower cost per lead, direct mail leads will not be the best option for you.

#6-Final Expense Telemarketing Leads

Telemarketed leads are in my opinion, the bottom of the barrel when it comes to selling final expense life insurance over the phone or working remotely.

Yes, I see the appeal in others calling and setting appointments or generating an interested lead. I don’t know anyone who doesn’t understand the appeal with this.

However, keep always referring to trust and rapport with final expense prospects. Seniors are called all day long for everything under the sun. Medicare, Medicare Supplements, Back Braces and Cruises to Jamaica for free!

Telemarketed leads are usually generated in a third world country such as the Philippines to keep the cost low. Well, when you do this, you have someone who is not licensed in life insurance. Someone who knows nothing about final expense life insurance industry or the products offered.

Additionally, you likely have an individual who may not speak excellent English and chances are, they are going to annoy your prospects more than anything.

Now, factor in that you still need to pay for these leads, manage your cold callers and deal with prospects that don’t even prefer to speak to you, and you quickly have a lead source that ends up at the bottom of the barrel in my eyes.

Can they work? Yes, they can. I’ve made them work. It wasn’t fun, and after learning all my other options, I never once used this method again.

I doubt I ever will either, and if you want to take some friendly advice, I wouldn’t bother with them. So many better options exist and won’t cost that much of a difference on your bank account.

#7- Live Transfer Leads (Final Expense)

Live transfer leads can be decent. Especially if you are licensed in multiple states and can negotiate a deal with a reputable live transfer lead dealer/vendor such as Data lot.

News flash. There is no guarantee that they offer you any break on price. It’s merely a recommendation. I also have no affiliation with Data lot or any other lead source we discuss in this post.

This is purely advice that only you can benefit from.

Live Transfer Leads Are Not for Beginners in the Final Expense Market

If you are getting tired of me saying this, I’d just get used to it or scroll down. Once again, final expense telesales all comes down to rapport and trust. This is a learned skill for many new agents. Can it be learned?

Yes.

Fairly quickly too. However, live transfer leads although high quality can be pricey. Often, they can run 25.00-40.00 dollars for one lead. If you are new and haven’t learned the best methods for closing the sale or building rapport, this is not the lead to practice on unless you have an unlimited budget.

Which I highly doubt is the case.

Live transfer leads should be more geared towards seasoned agents who need ultimate control of their time and calendar. Why would this give ultimate control of your time?

You select the times. You pick when you are willing to take transfers. This includes days of the week and time frames. Let’s say you are a stay at home mom who can lock down a sale with nearly anyone you speak to that’s already interested.

Well, if you have free-time to close deals is Monday, Wednesday and Friday between 12-5pm, you can simply select this time for your live transfers to be active.

Again, I believe live transfers should be a supplement source and nothing more unless your very talented closing the sales at high percentages.

Exclusive Leads and The Power of Knowing the Source (Internally Generated)

I know we touched on this briefly earlier in this article, but I want to discuss it one more time. You should always be looking for exclusive leads, and you should still be afforded the ability to know the source of the lead.

If you aren’t afforded this information by the vendor you are considering purchasing from, you should run away and look for a plan B for your leads. This is such a game changer that I thought it needed to be discussed one more time.

Often, agencies that develop leads to turn a profit won’t give up as much of this information to you as an agency who produced the leads for its agents in house and to honestly see you succeed in the final expense market.

So, what do you do? ASK THEM! If you are speaking to an agency about the leads available, ask questions such as the following to get more clarity.

• Where are Your Leads Generated?

• How Are Your Leads Generated?

• What’s the Cost of The Leads?

• What’s the Estimated Contact % or Placement %?

Yes, I understand the contact % and placement % vary. However, don’t let the Agency you are speaking with use that a reason not to disclose averages or answer your questions. Any reputable agencies will act as an open book with this information and if they don’t, move onto the next option.

Or simply take the deal anyway and kick yourself in the butt later for it like I have several times.

Working with an Agency Who Offers Final Expense Leads at Cost

This is key. I can’t emphasize it enough. Find an agency that genuinely wants to help agents. Not just pad the bottom line. While the bottom line is essential for any Agency or Brokerage, it’s typically easy to spot one that stands out from the crowd.

These Agencies offer leads at cost. They offer coaching and sales training at no cost. Great agencies even offer technology at no cost such as the CRM (Customer Relationship Manager).

Your task of entering and learning the market in final expense can be easy with the correct agency backing you up.

Having the ability to work leads at cost and having an Agency that wants you to succeed and build your business can help in too many ways to even discuss in this post.

Trust me, I’ve been there as well. I’ve worked about every lead source possible and worked with Captive Life Insurance Companies and different agencies and brokerages.

An agency that offers real value will stick out and be noticed very quickly for anyone who has been in this business for any amount of time or even an individual just beginning their journey.

You, Will, Have Questions and You Will Want Answers

With leads, whether you are new or not, you will have questions and frustrations that arise. When they happen, you will want answers, information, and help.

This is another crucial spot that working with the right agency can make or break you.

Are they going to provide any insight, coaching or answers? Maybe they suggest something different based on your numbers or skills set?

Whatever the case may be, working leads can get costly if you are flying blind but if are actively developing your skills and learning the final expense market with some help, you can make final expense leads from any source profitable.

What you put into your business is what you will get out of your business. Furthermore, who you do business with or invest your trust with, is going to determine how far you can really go.

Trust me on this point as well. I have over 2 years of switching and finding the right leads and Agency to work with that I will never get back. Save your time and money now and get it right the first time.

Begin Actively Learning and Building Your Own Marketing Skills

Okay, so we know the potential lead sources you can work. What happens when you start really investing in yourself or working with the correct Agency/ Brokerage who cares?

You start becoming unstoppable is the answer. You stop depending on lead sources or running the risk of lead sources drying up on you.

But how does this happen?

You learn your marketing methods and strategies while building your business and determining the final expense telesales market.

Perhaps you become the master of generating Facebook leads and maybe you begin your blog about individuals who need life insurance and have a niche health condition.

Whatever the case may be, when you invest time and work under an Agency that has experts in these areas, you can begin truly building your own business or discovering your true passions in the life insurance industry.

Some of you may even learn that you love marketing or develop a passion for it. The good news? Developing a passion for marketing and generating leads will still allow you to work remotely and remain in the life insurance industry.

Finding the correct combinations of leads, marketing, and a fantastic Agency is how your career or life begins reaching places you never believed were possible.

How Would I Ever Generate My Own Leads?

First, I’m not going to break this down step by step for you because it would take 30,000 plus words in this post and I’m sure at this point in your search, you would get bored with the information.

I’ll keep it simple. Start by working trusted, quality leads and invest an hour a day at learning something related to marketing and generating your own leads. Perhaps you wake up one hour early to learn about Facebook advertisements, or you stay up one hour late to write a blog post.

It’s not essential to know everything today, it’s just important to work leads, make dials, make sales and to continue learning as much as possible. Treat yourself like a sponge absorbing information in the early stages of your career and let the knowledge build. Eventually, you are going to have your Ah Hah moment.

Trust me, it does happen.

How Much Will These Final Expense Leads Cost Me?

This entirely depends on which form of final expense leads you choose to work, how great you become making sales and how many leads you work. Quality leads using SEO from an Agency above you, or even social media leads can range from 15-18.00 dollars and are worth every penny.

Let’s say you order roughly 200 of them for the month, you may spend 3200.00 for a fair amount of leads to get you kickstarted. Leads from these sources, when trusted and developed at cost, should be placing around 3-7%. Sometimes higher depending on your skills and patience with the final expense life insurance market.

Let’s assume you meet in the middle of this figure and close 5% of your sales. By close, I mean you place the sale, finish it and get paid.

5% of 200 leads closing will net you 10 Sales. An average annual premium in the final expense market will range between 700-800.00. If this is this is the case, you just turned your 3200.00 into 7,000-8,000, and this is assuming you aren’t even fantastic on the phones yet.

This is very lucrative when you start producing more and more as time goes on.

All you need to do from here is scale your business and continue to learn and grow.

How Many Leads Should I Be Working?

This ultimately depends on your work ethic, desire to earn more money and time you can spend making dials. A full-time final expense agent selling over the phone can handle 500 leads plus (Often 700 or so) with only 1 person.

This does require a full-day of dialing from a priority based click to call CRM system. This could total about 150-200 dials a day to work these leads effectively. It is 100% possible. I’ve worked over 1000 in a month alone.

Was I busy? Yes. Was I making a ton of sales? Absolutely. It depends entirely on your comfort level and hunger. Maybe you are sick of an old job and ready to prove you can make a killing in this industry.

Great, go after it. Perhaps you don’t have that kind of time and want to call 300 leads a month and have time with your family.

Whatever the case may be, using quality leads to market final expense life insurance over the phone offers flexibility and endless possibilities if you take the time to learn it and develop your skill set.

Don’t Allow Your Sales Pipeline to Dry Up, Continue to Reinvest in Leads

Part of figuring out your sweet spot with how many leads you can work directly relates to your sales pipeline. Starting your pipeline is the hardest part of this business. Sale #1 is the beginning of something beautiful when working quality leads.

Making every effort to never allow your pipeline to dry up is the name of the game and how you turn working from home selling final expense life insurance into a 6-figure income way faster than you may have anticipated.

Always keep tabs on your pipeline and ensure cases will be placed each month. Never allow it to dry up, or you are basically starting from scratch.

Once you understand these fundamental principles, things can become very exciting, and I personally guarantee, you will be doing everything you can to learn more as fast as possible to drive your income and freedom to entirely new levels.

The Importance of Cash Flow to Continue Scaling Your Business

The next key to consider when purchasing leads comes down to, quality and cost, and of course, your own cash. You must manage it. You can’t get too excited about the potential and get careless. Trust me, I’ve been in that spot too.

While it ended up perfectly fine for me due to having a great Agency and the will power to push through, I won’t lie and say it wasn’t scary as hell.

You need to manage your cash flow and always be setting aside additional cash from life insurance policies sold towards your next set of leads you need to purchase for the following month.

For me, this wasn’t the issue. I was overly excited about what this market can offer that I wanted about every lead I could get my hands on and didn’t take into consideration future cash flow or the mere fact that one agent will eventually bottleneck with too many leads. This can turn profits into losses.

Break yourself in slowly and understand what number works best for you. Always invest in yourself, your business and future and not in a brand-new BMW with your sales and current pipeline and you will be just fine. The BMW can come later and will eventually happen. Just not in the very beginning.

Finding Niches for Final Expense Leads Be the Professional and Expert

This is somewhat advanced when discussing final expense life insurance leads, but I find it very important and worth mentioning. Outside of learning the lead sources and quality, you need to learn some unique niches.

This can help you in many ways. First, you can become an expert in this niche. Maybe you are just a dominant force closing sales over the phone with prospects that are females age 50-70. Perhaps you are even better at helping people who have had cancer in the past.

Whatever the case may be, take advantage of the niche and your knowledge and have some confidence in yourself. This is when you can skyrocket sales.

When you’re ready, take further advantage of your niche underwriting knowledge in the final expense life insurance market and use it for your own marketing like discussed before.

Maybe you blog about your knowledge or how you can help these individuals or maybe you decide to target individuals on Facebook based on your skill set.

Whatever the case may be, taking advantage of niche markets and using it to your advantage is huge towards your success.

Getting into A Rhythm With A Few Lead Sources, Diversify When Possible

Now, that we have some strong base knowledge working in our corner, we can begin to expand on this topic some and make you a beast on the phones and making sales.

Tip #1- Diversify. Mix Up Your Sources

Sell final expense life insurance over the phone using Facebook ads and SEO generated leads or even other sources such as aged leads or live transfers. Have leads feeding into your CRM from multiple sources.

Technology and what works today changes so rapidly that there are never any guarantees in this market and when you get to cozy or decide that learning more and developing your skills is not your cup of tea, is when you are going to get slammed and run into issues.

Stay diversified, mix up lead sources and keep learning as much as possible. Become a well-rounded agent that can work leads from any source at any given time to become elite.

Tip #2- Diversifying is Great but Don’t Fix What’s Not Broken

Again, you need to diversify but don’t run from something that’s working fantastic. Especially if it’s still available and keeping you profitable every month. If SEO generated, leads are killing it for you and your Agency can keep feeding you these leads at a reasonable cost, KEEP BUYING THEM.

Don’t get scared right when things are getting good and think that a change is needed. Money in your bank is the only indicator you need. Maybe if you are crushing it, you can consider adding another lead source into your next batch but don’t ruin something that’s working and working well.

Turning Up the Heat and Producing More Income

Alright, now you know the pieces to the puzzle of understanding and purchasing final expense leads that can be sold with ease over the phone. Now it’s time to turn up the heat and start working towards that BMW that we referenced previously in this post.

If it’s working, it’s time to get out the business credit card and turn up the power some. If you don’t have the credit, find some. Credit card companies now make great offers for individuals at zero percent interest where you can gain some immediate cash flow.

Keep buying and stacking your pipeline as much as possible to develop and grow your business. I do entirely understand some fear and hesitation that can come along with this and buying leads. I was scared some as well as starting my business, but ultimately, I pulled the trigger and made the purchase every single time.

Why, because it was working. I was just getting the initial shock of starting a pipeline and waiting for things to develop and begin paying out. This is the scariest part. This was also working some traditional life insurance leads.

Your Advantage? If you contract with the right telesales equipped final expense carriers, you won’t even have the issue I ran into. These companies pay quickly and approve cases quickly.

Typically, they are built around simple yes or no medical questionnaires. This changes everything for those of you looking to pivot into final expense life insurance sales over the phone.

Some Final Pieces of Critical Advice Selling Final Expense Life Insurance Over the Phone

My final pieces of advice are simple but essential to agents just beginning or thinking about beginning. Is buying leads and working final expense life insurance over the phone a real money-making opportunity?

Yes. Absolutely.

Will you have times where you don’t know how many to buy, where to buy them and where you are scared to continue purchasing them?

Yep, you sure will. My advice?

Stick with it. It can create more income than you could imagine and again, working with an Agency that cares and runs their business the right way is where all the difference is. The scariest part about buying leads and learning the sources is the first few months.

It does get more comfortable and tomorrow will come. Every day is a new opportunity in final expense life insurance sales. Especially when you are selling it over the phone.

Think of all the people you can reach from your own home using the phone calling multiple states!

Putting It All Together, Many Options Exist, Find Your Groove and Scale Your Business

At the end of the day, working final expense life insurance over the phone will have you in this world where you are always looking for leads, sources and different ways to do things. My advice. Find a trustworthy source right out of the gates and stop searching when something works.

Stop searching but don’t stop learning. Over time, things will change. That’s life and the way the world works but if you continue to learn, adapt and try at final expense life insurance sales over the phone, you can do things you never believed possible.

What Digital Senior Benefits Can Do to Help You Through This Process

I saved the best for last. If you are looking for an opportunity, need to understand more about leads and sources or even need to understand this business a bit more in-depth, be sure to email us at info@digitalseniorbenefits.com

We develop all our leads in house and offer them to agents at cost using only the best sources we discussed in the post.

Additionally, we provide your CRM to you for no-cost and can help contract you with some of the best life insurance companies entirely built for selling final expense life insurance over the phone.

If that’s enough to get you excited, we also offer a conservation team to call your clients who are pending lapse or missing payments to eliminate this stress from you and keep you making more sales.

Ultimately more sales are how you succeed in this business. What are you going to do about it?