Final Expense Telesales

THRIVE in Final Expense Telesales and Partner With Malamud Insurance Services, Inc.

Click Here To Learn More and Speak With Us

My name is Myron Malamud. President of Malamud Insurance Services, Inc.

I have 15 years of experience in the insurance industry. As a top producing agent in digital final expense telesales, I will help you reach your personal and business earnings goals.

I have learned what works and what doesn’t.

Partnering with me and my tech support partner, Digital Senior Benefits, gives you access to exclusive life insurance leads, a proven sales method, training, one-on-one coaching, and powerful final expense sales automation software.

By following my proven sales methods you will become highly profitable in your very first-week selling!

Click Here To Learn More and Speak With Us Coronavirus has changed the world and how businesses operate… life insurance sales is no different.

This isn’t your fault. Conditions have changed.

Our prospects are quarantined and at the same time are losing their jobs and income at record speeds.

Opportunity comes from a changing environment.

Final expense telesales is experiencing the biggest rush of business it’s ever seen. Agencies are having the best months, weeks and days of their existence.

But why? 3 core reasons:

1) Seniors are feeling vulnerable and have a greater sense of urgency to buy an affordable final expense life insurance plan. They are seeing data daily that is consistently showing that seniors are the most susceptible to being hospitalized and have highest death rate with COVID-19.

2) Quarantines mean seniors are home and picking up their phones. Contact rates on leads have increased by over 34%!

3) Most seniors are on a fixed income guaranteed by the government. Seniors aren’t as impacted and aren’t seeing a significant threat to their financials.

At Malamud Insurance Services, Inc. we’ve never seen this big of a spike in contact rates and conversions to sale. This is expected to last for months and when the threat is finally over, the lasting effects will still make final expense telesales a hot market.

While most of the world is worrying about their job or their business, we are VERY fortunate in the fact our business can be done 100% over the phone and from home during these recommended quarantines.

But I know what you’re thinking…final expense? Really? People on a fixed income?

Every month, we have agents writing over $30,000 of final expense life insurance over the phone at 110% contracts.

Click Here To Learn More and Speak With Us

At Malamud Insurance Services, Inc. Here’s What We Have For You

Of the many choices you have to align yourself with, we separate ourselves by serving the telesales final expense life insurance agent only and do it better than anyone else.Here’s what that entails:

• Benefit #1: Free final expense sales automation software ($400/mo value)

• Benefit #2: Plentiful Final Expense Leads Including (Live Transfers, Telemarketed Callbacks and FB Managed Campaigns)

• Benefit #3: Best in class training

• Benefit #4: High contracts – 110% WITH a conservation team

• Benefit #5: Community support

We’ll explain each one of these in detail below…

Benefit #1: FREE Final Expense Sales Automation Software

This is a plug and play system. Everything is setup for you to receive leads and make sales on day 1.

All your leads will post into your CRM automatically. The technology then displays the next best lead to call.

You simply click the “Dialer” button and it starts dialing until you’re connected with someone. Everyone who doesn’t pick up gets automatically dispositioned and will receive an automated email or text message (that is fully customizable).

Here are some of the benefits of the system.

🗸 Receive inbound calls, texts and emails from the system

🗸 Customized pre-qualification links get sent to your prospects automatically. 6%-8% of your prospects will complete a health questionnaire without even speaking with you. This is one example of the system working for you.

🗸 Reporting. View your contact and sales percentages for any date range and lead source. Compare where you are to the benchmarks Insure Legacy share with you.

🗸 Call recordings. Not only for compliance but listening to your calls is a great way to get better on the phone. It also allows us at Insure Legacy to coach you and provide feedback.

🗸 1-click quoting. You don’t need to use a separate program to quote all the final expense carriers we represent at Insure Legacy. You don’t even need to re-enter Date of Birth, gender, or coverage amount. Digital Senior Benefits platform compares all plans from all final expense carriers built-in.

We have training on our sales platform several times per week and you can get 1 on 1 time. Guaranteed.

An integrated sales platform for independent agents like this does not exist in the industry. You typically have to piece together everything and it becomes costly and hard to manage.

Click Here To Learn More and Speak With Us

Benefit #2: Final Expense Leads

Do you know what performs better than any data lead on the market, including Facebook, Google Ads, and SEO?

Telemarketed Call Backs delivered in real-time.

Every telemarketed call back lead will have:

1) An interest in getting quotes for final expense life insurance2) A verified checking account (no direct express!)

3) Between the ages 50-79.

These telemarketers are calling on TCPA verified data, not cold calling (big differentiator of other telemarketed lead callbacks). Meaning our telemarketers are calling on Facebook leads or web forms that have Journaya or Trusted Form verification. Which simply means there’s a snapshot (a literal video recording) of every lead filling out a web form for compliance.

We go a step further and scrub each lead that gets generated through the TCPA Blacklist Alliance API. Which protects us and you from professional litigators trying to sue agents for breaking TCPA laws. This is SO important if you’re working telemarketing call-backs.

This may sound like gibberish to some of you, but just understand that we are serious about compliance and we’ve got an amazing lead system in place.

You’re probably thinking a lead like this would cost at least $25, right? Nope.

We’re generating these at $12 each for our agents. Only agents on our platform have access to this lead.

We have other lead sources that you can work on top of these, but these are closing at the highest percentage right now and everyone should take advantage of these while we have the capacity.

Benefit #3: Best in-class training

Telesales is all about building rapport and doing it in a way that’s sincere. But also at the same time controlling the call, establishing that you’re the expert and earning your prospect’s respect.

It’s about recognizing smokescreens at the beginning of every call and how to handle them so you can make more full presentations.

It’s about getting better with every final expense interaction you have.

Yes, we have a masterful script, however, the script isn’t everything. It takes training and simply more presentations. You’ll get better with every presentation.

Malamud Insurance Services, Inc., we been 100% telesales focused since our inception and have the training to make you become a final expense telesales expert.

Benefit #4: High contracts – 110% WITH a conservation team

We keep commission levels high AND have a conservation team that will follow up on any NSF’s and pending lapses on your behalf.

We write Royal Neighbors, Trinity/Family Benefit Life, Prosperity Life, Liberty Bankers Life, Mutual of Omaha, Sentinel Security, Aetna, AIG, Great Western and Guarantee Trust Life.

If you’re contracted with any of those carriers, you will have to get released first.

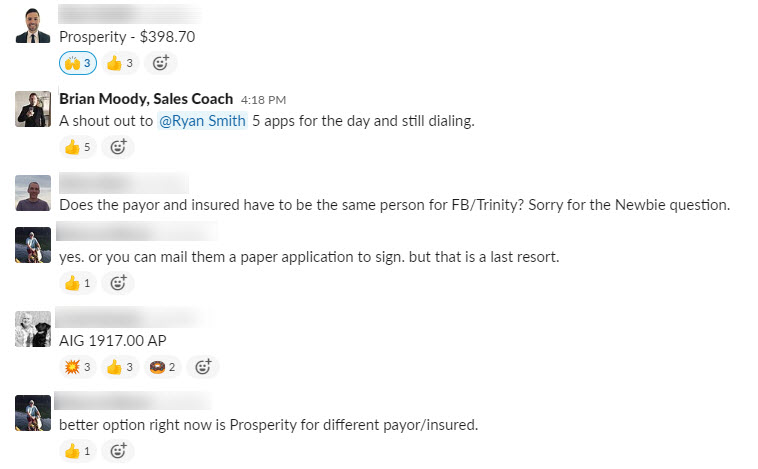

Benefit #5: Community Support

You’ll be plugged into a Slack channel (screen shot on the right) where agents are interacting every day and posting their sales and just daily life that final expense telesales agents experience.

Here’s What Digital Senior Benefits Platform Will Do For You

You’ll plug into an earning engine and own ALL your business 100%.

You no longer have to piece together a sales system. It is ready for you.

You no longer have to “test” lead sources. We put our name and reputation behind every lead source we offer.

All you have to do is purchase leads and work the system we’ve created. If you can do that, you’ll be very profitable right out of the gate.

We’re seeing new agents making a killing within their first 4 weeks.

At the time of writing this, our telemarketed call back leads are $12.

Agents issue policies on 4%-10% of our telemarketing call back leads.

Average premium is $740.

If you issue 4 policies out of 100 leads (4%), that’s $2960 on a $1200 spend.

If you issue 10 policies out of 100 leads (10%), that’s $7400 on a $1200 spend.You’ll fall somewhere between there as long as you work the system.

The image above is a screenshot from the CRM of one of a high performing agent for March 2020. 70% contact ratio and over 10% sales rate.

It just becomes a matter of how many leads are you willing to purchase every day/week/month.

On the platform you can take 800+ leads comfortably every month and stay on top of all your leads.

Writing $40,000-$50,000+ every month is very attainable for those who want it bad enough.

Here’s How To Join Insure Legacy Now

We don’t take everyone.

You must fit ALL 3 of these requirements:

1) Must be willing to take at least 10 leads/day and spend $600/week to start.

Most of our top performers take 20-40 leads/day and make multiple sales every day.

This is the only cost of doing business.

You’ll be profitable within 2 weeks and thriving (ie very profitable) shortly after.

2) Must have at least 7 state licenses or be willing to pick up more licenses.

Applying for licenses is as easy as making a payment online through NIPR and each license costs between $50-$150 depending on the state.

We have this requirement so you can get a solid lead flow. If you only have a few states, your lead flow won’t be consistent.

3) You must have all of your final expense contracts mentioned above with Insure Legacy (A Partner Of Digital Senior Benefits)

No exceptions on this. If you need to get releases, that has to happen before we let you on the platform and access training and leads.

It’s worth noting here that we have an open-release policy. If this doesn’t work out for you (hey, telesales isn’t for everyone), we’ll release you immediately.

If you can meet these 3 criteria, please schedule a call below.

Here’s Why You Should Join Now

Again, it is the absolute best conditions to sell final expense life insurance over the phone and it will be for the next few months.

Seniors are feeling vulnerable in this once in a lifetime pandemic. Combine that contact percentages WAY up with the quarantines and anyone getting started and plugged into our systems will see success.

Based on current conditions, we can only take less than 30 new agents to make sure we can meet their daily lead flow along with our current agent’s needs.

This isn’t some sort of scarcity tactic.

If you meet all 3 of the criteria above, we welcome you to click the link and complete the form. We’ll reach out and answer any questions you have and provide you next steps to get started with Insure Legacy (Partner Of Digital Senior Benefits)

Click Here To Learn More and Speak With Us